Health care costs eroding Social Security benefits

- Details

- Published on 20 June 2016

- Written by The Peorian

Unexpected health care costs and other life events have many recent retirees – those retired 10 years or less – wishing they waited to begin collecting their Social Security benefits. By drawing Social Security too early, many retirees are leaving money on the table that could help.

Unexpected health care costs and other life events have many recent retirees – those retired 10 years or less – wishing they waited to begin collecting their Social Security benefits. By drawing Social Security too early, many retirees are leaving money on the table that could help.

The third annual Nationwide Retirement Institute® survey,conducted online by Harris Poll among 909 U.S. adults age 50 or older living in or approaching retirement, finds that about one in four recent retirees (23 percent) would change when they started drawing Social Security to a later age. Of those recent retirees who wouldn't change, 39 percent say they were compelled to draw when they did by a life event.

More than a third of current retirees (37 percent) say health problems keep them from living the retirement they expected and 80 percent of recent retirees say those health problems came earlier than expected. Health care expenses specifically keep one in four current retirees from living the retirement they expected.

"The average American claiming at 62 will spend about 61 percent of their monthly Social Security benefits on health care costs," said Dave Giertz, president of sales and distribution for Nationwide. "That's why it's so important to optimize Social Security. Too many American workers need the money, but are missing out on hundreds of thousands of dollars in retirement income by not maximizing their benefit."

Almost one-fourth of future retirees expecting to receive Social Security (23 percent) either guess or don't know how much their benefit will be. At the same time, nearly three in 10 current retirees (29 percent) say their Social Security benefit ended up being less than they expected.

In the new Nationwide survey, future retirees say they expect to get $1,610 in monthly Social Security benefits. While recent retirees report their actual monthly benefit is about $1,378, those who have been retired longer reported receiving just an average of $1,185 a month.

Complicating matters more is that 86 percent of future retirees cannot correctly identify the factors that determine their Social Security benefit amount. As a result, many retirees do not know how to maximize their Social Security and cannot accurately determine their benefit amount.

"Social Security is undoubtedly one of the most complex retirement topics facing American workers," Giertz says. "Even those who can identify the factors that will impact their benefit are likely unable to grasp the thousands of rules that apply to Social Security. The complexity makes it extremely difficult for retirees to maximize their benefit on their own."

While only 11 percent of current retirees used an online calculator to estimate their benefit, among those approaching retirement, the use of these tools is becoming much more prevalent. More than four in 10 future retirees (42 percent) used a Social Security calculator to estimate their benefit.

The Nationwide Social Security 360 Analyzer provides a comprehensive look at Social Security filing strategies in the context of an individual or family's circumstances and retirement income needs.

"The development of Social Security calculators is helping to close the Social Security knowledge gap – and combined with the holistic perspective of an advisor, American workers can position themselves to live their dream retirement," said Kevin McGarry, director of the Nationwide Retirement Institute. "However, we find that this year, even fewer Americans are working with a financial advisor to prepare for retirement. In fact, just 11 percent have talked to an advisor about Social Security."

Fortunately, those nearing retirement are more likely to have the Social Security discussion. About one-third of future retirees (32 percent) work with a financial advisor – but only half of these (52 percent) say their advisor provided advice on Social Security. It's not that they don't want advice. In fact, 76 percent of future retirees who work with a financial advisor – or plan to – say they are likely to switch to one that could show them how to maximize their Social Security benefits.

Retirees who work with an advisor are much less likely than those who don't to say health problems keep them from living the retirement they expected (25 percent vs. 41 percent) and also are much less likely to say health care costs keep them from living the retirement they expected (11 percent vs. 29 percent).

"It's no secret the retirement income landscape, and Social Security, is changing for the next generation of retirees," McGarry said. "Only 36 percent of the future retirees we surveyed have pensions, compared to 54 percent of recent retirees, and 60 percent of the oldest retirees. In this new era, Social Security is an even more important component of a worker's retirement income plan. Working with advisors can help retirees face the challenges posed by lack of savings, longevity, health care costs and other obstacles."

For more information visit www.nationwide.com/socialsecurity

Methodology: The 2016 Social Security Study was conducted online within the United States by Harris Poll on behalf of the Nationwide Retirement Institute between Feb. 16 and Feb. 23. Respondents comprised 909 U.S. adults aged 50 or older who are either retired or plan to retire in the next 10 years and collecting Social Security or planning to. Data are weighted where necessary by age by gender, race/ethnicity, region, education, household income, retirement status, and propensity to be online to bring them in line with their actual proportions in the population.

Cat employees giving back in Summer of Service

- Details

- Published on 17 June 2016

- Written by Paul Gordon

It was a beautiful morning on Friday, the kind of day that would make anyone want to get away from work and stay outdoors. For 22 employees in Caterpillar Inc.’s Global Supply Network division, that’s what happened.

It was a beautiful morning on Friday, the kind of day that would make anyone want to get away from work and stay outdoors. For 22 employees in Caterpillar Inc.’s Global Supply Network division, that’s what happened.

But they would have been at Glen Oak Park on the east side of the lagoon regardless of the weather. They were volunteering on a project that helps them – and the company – give back to the community by doing something others may not want or be able to do.

These 22 volunteers in bright yellow t-shirts used basic gardening tools to clean out more than 100 feet of brush from the east side of the lagoon so the water and the fountain could be seen and enjoyed from an area of the park that hasn’t had that pleasure for a while.

“It was overwhelming at first, when we got here and saw how much needed to be cleared out,” said Amanda Scott, a transportation analyst for Caterpillar for two years. “Now, two hours later, it’s unbelievable how much we’ve gotten done. It looks nice.”

These 22 were just a small portion of the 500 employees who have signed on to various projects in Caterpillar’s first Summer of Service. The Glen Oak project was the first but many more are scheduled throughout the summer as part of the Summer of Service project the company devised as a way of giving back, said Pete Chambers, an energy and commodity analyst for the company and one of the volunteer coordinators.

These 22 were just a small portion of the 500 employees who have signed on to various projects in Caterpillar’s first Summer of Service. The Glen Oak project was the first but many more are scheduled throughout the summer as part of the Summer of Service project the company devised as a way of giving back, said Pete Chambers, an energy and commodity analyst for the company and one of the volunteer coordinators.

“There are many of us at Caterpillar who volunteer for different things in the community. We formed this small committee after we were challenged by our leadership to think big. And we came to realize that when we work together we can accomplish a lot. We want to live our values through our actions and this gives us the opportunity to do that,” Chambers said.

“This community is so important to Caterpillar we feel it is our duty to give back one way or another. This gives us those opportunities while also helping to build teamwork within our division. It also gives us a chance to get to know each other. We are in three facilities around Peoria and there are people from all of them in the group,” said Chambers, who was born and raised in Peoria.

Caterpillar plans to take the Summer of Service program and share it with employees in other parts of the world where the company does business. Chambers said that is good stewardship because the company believes it is important to do good works in the communities where its employees live and work.

When work started on Friday, shortly after 8 a.m., one could not see the lagoon or water fountain from the roadway on the east side of the water. By 11 a.m., one could not only see through the remaining trees but could walk through them and down the slope to reach it.

“It look beautiful from up here, now,” Scott said. “This is a great way of showing the community that we care. This won’t be my last time doing this.”

Future projects include other clean-up opportunities, including in July when volunteers plans to clear brush and debris from the Meadow Valley Trail in Washington because the debris is hindering the growth of new trees that were planted to replace some ripped out by the November 2013 tornado, Chamber said. So far, 30 projects are in the works in the Peoria area and central Illinois, including in Hanna City and Bloomington.

The Summer of Service’s first year culminates in September, but Chamber said he is sure it will resume next year.

Manpower: Stable hiring practices expected in Q3

- Details

- Published on 15 June 2016

- Written by The Peorian

U.S. employers indicate stable hiring plans for the third quarter of 2016, according to the latest Manpower Employment Outlook Survey, released today by ManpowerGroup (NYSE: MAN). Taking into account seasonal variations, the Net Employment Outlook is +15 percent, making anticipated hiring relatively stable, both quarter-over-quarter and year-over-year.

U.S. employers indicate stable hiring plans for the third quarter of 2016, according to the latest Manpower Employment Outlook Survey, released today by ManpowerGroup (NYSE: MAN). Taking into account seasonal variations, the Net Employment Outlook is +15 percent, making anticipated hiring relatively stable, both quarter-over-quarter and year-over-year.

View complete Q3 2016 survey results for the U.S.: www.manpowergroup.us/meos

Of the more than 11,000 U.S. employers surveyed, 23 percent anticipate increasing staff levels in the third quarter. This is a 1 percent increase from the second quarter and a 1 percent decrease from the third quarter 3 of 2015. Five percent of employers expect workforce reductions, and 71 percent expect no change in hiring plans. The final 1 percent of employers are undecided about their hiring intentions, resulting in a seasonally adjusted Net Employment Outlook of +15 percent.

"Although employers have been increasingly cautious for the last three quarters, the U.S. hiring outlook is among the strongest globally, and we expect to see modest improvements in the labor market throughout most of the country," said Kip Wright, senior vice president of Manpower in North America. "This is good news for job seekers and organizations; as the competition for talent heats up, the way in which companies engage individuals is more critical than ever. Employers need to ensure they have the skills and resources they need – right when they need them."

| Quarter | Increase Staff Levels | Decrease Staff Levels | Maintain Staff Levels | Don't Know |

Net Employment Outlook (deseasonalized) |

|

Q3 2016 (current) |

23% | 5% | 71% | 1% | 15% |

|

Q2 2016 (previous quarter) |

22% | 4% | 72% | 2% | 16% |

|

Q3 2015 (one year ago) |

24% | 4% | 70% | 2% | 16% |

U.S. Hiring Plans by Regions, Industry Sectors and Metro Areas/States

Quarter over quarter, U.S. employers in the Midwest, Northeast and South anticipate a slight decrease in hiring, while employers in the West expect hiring to remain relatively stable. Compared with one year ago at this time, the Outlook is relatively stable in the Northeast and the West, and declines slightly in the Midwest and South.

Employers have a positive Outlook in 12 of the 13 industry sectors included in the survey, with Leisure & Hospitality (+23%), Wholesale & Retail Trade (+20%), Transportation & Utilities (+19%) and Professional & Business Services (+18%) employers reporting the strongest hiring intentions.

Among the 50 states, employers in Maine, Idaho, Montana, Delaware, Oregon and Kentucky report the strongest Net Employment Outlooks, while Louisiana, New Jersey, Oklahoma, Nevada and Wyoming project the weakest Outlooks.

Among employers in the 100 largest metropolitan statistical areas, the strongest job prospects are expected in:

- Albany, New York

- Richmond, Virginia

- Charleston, South Carolina

- Salt Lake City, Utah

The weakest outlooks are projected in:

- New Orleans, Louisiana

- Baton Rouge, Louisiana

- Philadelphia, Pennsylvania

- Oklahoma City, Oklahoma

- Bakersfield, California

Complete results for the Manpower Employment Outlook Survey are available for download at www.manpower.us/meos. The next survey will be released Sept. 13, 2016 to report hiring expectations for the fourth quarter of 2016.

Economy showing resilience, bouncing back

- Details

- Published on 16 June 2016

- Written by PRNewswire

The American economy is showing its resilience, bouncing back with gusto after a slow start to the year, according to a new report by TD Economics (www.td.com/economics), an affiliate of TD Bank, America's Most Convenient Bank®.

The American economy is showing its resilience, bouncing back with gusto after a slow start to the year, according to a new report by TD Economics (www.td.com/economics), an affiliate of TD Bank, America's Most Convenient Bank®.

"Consumers burst out of the gates in the second quarter, providing a strong impetus to economic growth," says TD Bank's Chief Economist,Beata Caranci. "Supported by accommodative interest rates and rising wages, consumer spending and housing investment will continue to lead economic growth over the second half of this year and into 2017."

With this backdrop in place, job growth is likely to re-accelerate in the months ahead, pushing unemployment to a new low and providing greater full-time job opportunities to those who want them. TD Economics projects economic growth of 1.9 percent in 2016 and 2.1 percent in 2017, enough to bring the unemployment rate from its current level of 4.7 percent to 4.3 percent by the end of 2017.

The job market is stronger than recent headlines suggest

The resilience of the labor market has been an important factor driving recent economic performance. Ongoing job growth has given support to income gains and consumer spending. Job growth has slowed in recent months, leading some analysts to fret for the ongoing health of the labor market. "These fears are misplaced," says Caranci. "A broad number of indicators continue to show the job market continues to tighten."

Perhaps most encouragingly, job openings remain at record high levels, indicating ongoing demand for labor. Quit rates have also moved up and now sit at pre-recession levels. With strong labor demand and falling unemployment, wage growth has accelerated. Average hourly earnings are up 2.5 percent from a year ago and median wages (of full-time employed workers) are up 3.4 percent.

"Job growth is likely to rebound in the months ahead, but probably not back to the 200,000 level it has been over the recovery so far. We anticipate a more sustainable monthly pace around 150,000 over the remainder of this year and next, reflecting the move to more normal labor market conditions," says Caranci.

Low interest rates support consumer spending and housing investment

In addition to rising wages, household spending will be supported by record-low borrowing costs. With the recent decline in bond yields, mortgage rates have returned to rock bottom levels last seen before the taper tantrum in 2013.

"As a result of low rates and past deleveraging, household debt service costs are currently sitting near 30-year lows," says Caranci. "With income growth accelerating, they are likely to remain low for the foreseeable future, even as household debt growth is likely to move higher."

Interest-rate sensitive categories of spending like housing, autos, and other consumer durables will continue to perform well over the next year. With strong demand fundamentals, housing construction is also expected to increase.

Federal Reserve will very gradually nudge rates higher

Interest rates are likely to remain accommodative, but with a tightening labor market and rising wages, inflation is also likely to move higher over the forecast. This will spur the Federal Reserve to continue to very gradually push up its policy rate.

"As inflation moves toward the Federal Reserve's two percent target, it will keep downward pressure on real borrowing costs," says Caranci. "This will give the Fed cover to raise rates without removing much accommodation. We anticipate at least one hike in the second half of this year, with two more likely in 2017."

The complete findings of the TD Economics report are available online athttp://www.td.com/document/PDF/economics/qef/qefmar2016_us.pdf

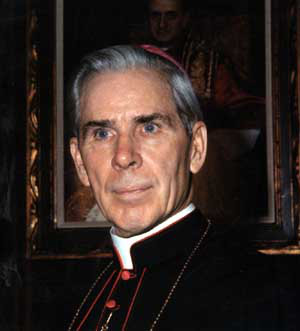

Fulton Sheen's family intervenes in beatification cause

- Details

- Published on 14 June 2016

- Written by Paul Gordon

The family of the late Archbishop Fulton Sheen has petitioned the New York Supreme Court to allow Sheen’s remains to be relocated to Peoria, an event that would expedite the cause for sainthood for the Peoria-area native.

The family of the late Archbishop Fulton Sheen has petitioned the New York Supreme Court to allow Sheen’s remains to be relocated to Peoria, an event that would expedite the cause for sainthood for the Peoria-area native.

If granted, Sheen’s remains would be removed from the crypt at St. Patrick Cathedral in New York City and placed in a crypt at St. Mary’s Cathedral in Peoria, where he attended church as a child, received his First Communion and was ordained into the priesthood.

The petition to the court was filed by Joan Sheen Cunningham, the Archbishop’s niece, who said she was extremely close to him while growing up and believes the transfer of his remains would be what he wanted.

The Diocese of Peoria, which started the Cause for Beatification under Bishop Daniel Jenky 14 years ago, said that effort can resume shortly after the transfer if it is granted by the court. The Cause was suspended nearly two years ago when the Archdiocese of New York declined to cooperate in the relocation of Sheen’s remains and the collection of relics, reneging on a promise made to Bishop Jenky 12 years earlier.

At the time it was believed the Cause for Beatification, part of the long process toward sainthood, was finished.

The Diocese, in a release Tuesday, said Bishop Jenky is “immensely grateful for the collaboration of Mrs. Joan Sheen Cunningham and her family.”

The Diocese said the Congregation of the Causes of the Saints, the office in the Vatican that oversees such matters, does not object to the transfer of the remains “and looks forward to the resumption of the cause.”

Msgr. James Kruse, the Vicar General of the Peoria Diocese, said he is confident the Archdiocese of New York will cooperate with the Sheen family. “On several occasions the Archdiocese has declared its desire to cooperate with the wishes of family. I cannot imagine that the Archdiocese would oppose the family’s petition presented to the court. It is our hope that the Archdiocese will offer their consent to this petition in order to expedite these matters,” he said.

Joan Sheen Cunningham, 88, said in her petition to the court that she was close to Fulton Sheen in her early years and later became his trusted friend and assistant. She helped care for him in his later years, until his death in New York in 1979.

Noting Sheen’s celebrity as host of a television program called “Life Is Worth Living”, for which he received an Emmy Award in 1951, Cunningham said her uncle reached countless people and became one of the Roman Catholic religion’s foremost teachers and preachers.

Bishop Jenky undertook the Cause for Beatification beginning in 2002 after receiving assurance the New York Archdiocese had no plans to do it in a letter from Edward Cardinal Egan. Cardinal Egan further assured Bishop Jenky he would consent to transferring Sheen’s remains to Peoria.

Cardinal Egan resigned as Archbishop of the Archdiocese in 2009. He died in 2015.

It was his successor, Archbishop Timothy Dolan, who refused to transfer Sheen’s remains for the final steps toward beatification.

The Cause for Beatification reached the point of having the beatification ceremony after medical experts and theologians validated that a miracle involving a newborn six years ago should be attributed to Sheen. The Cause was to go before the Pope’s advisors for a recommendation and finally to Pope Francis to declare Sheen “blessed” and to permit the beatification.

The case involves a stillborn baby born in September 2010. For over an hour the child demonstrated no signs of life as medical professionals attempted every possible life saving procedure, while the child's parents and loved ones began immediately to seek the intercession of Fulton Sheen. After 61 minutes the baby was restored to full life.

Upon the Pope signing the decree for the beatification, an additional miracle would lead to the Canonization of Archbishop Sheen, in which he would be declared a “Saint.”

No timetable for when the New York Supreme Court will hear the petition.