Poll: Most Americans feel the country is on the wrong track

- Details

- Published on 18 January 2017

- Written by PRNewswire

2016 has come to a close and, both politically and otherwise, 2017 sees a lot of changes on the horizon for the American people.

2016 has come to a close and, both politically and otherwise, 2017 sees a lot of changes on the horizon for the American people.

Thinking of the country as a whole, nearly seven in 10 Americans say that things in the country have pretty seriously gotten off on the wrong track (68 percent). Regardless of political party affiliation, a majority of Democrats (70 percent), Independents (71 percent) and Republicans (60 percent) feel this way. This sentiment is also particularly true among women (73 percent vs. 62 percent of men) and older Americans, ages 55+, compared with those 18-44 (65+, 73 percent; 55-64, 72 percent; 45-54, 69 percent; 35-44, 63 percent; and 18-34, 62 percent).

These are some of the results of The Harris Poll® of 2,192 U.S. adults surveyed online between Jan. 9 and 11, 2017. Complete results of the study can be found here.

The economic outlook

Turning to a broad look at the economy, Americans are largely split on where things will go in the coming year. Over one third each say the economy will stay the same (37 percent) or improve (36 percent), while more than one in four expect it to get worse (27 percent).

Economic optimism is highest among men (40 percent vs. 32 percent of women) and higher income households ($100K+, 41 percent; $75K-$99.9K, 43 percent; $50K-$74.9K, 35 percent; less than $50K, 31 percent). Republicans are also significantly more likely than both Democrats and Independents to believe the economy will improve this year (56 percent, vs. 20 percent and 37 percent, respectively).

The future at home

Looking at a micro level – their own households – a slight majority of adults say they expect their household's financial condition will remain the same in the first six months of 2017 (52 percent). One third, however, are optimistic that their financial situation will improve (36 percent), while just 12 percent say it will get worse. Generational differences are apparent as 70 percent of Matures expect their condition to remain the same while nearly half of Millennials expect things to get better (48 percent). Men are also more likely to expect improvements (38 percent vs. 33 percent of women).

Methodology

This Harris Poll was conducted online within the United States between Jan. 9 and 11, 2017 among 2,192 adults (aged 18 and over). Figures for age, sex, race/ethnicity, education, region and household income were weighted where necessary to bring them into line with their actual proportions in the population. Propensity score weighting was also used to adjust for respondents' propensity to be online.

AARP letter to Donald Trump

- Details

- Published on 17 January 2017

- Written by The Peorian

In a letter to President-elect Donald J. Trump, AARP CEO Jo Ann Jenkins outlines AARP's priorities for Americans age 50 and older, including protecting Medicare and Social Security, ensuring access to affordable health care coverage, and lowering the cost of prescription drugs.

In a letter to President-elect Donald J. Trump, AARP CEO Jo Ann Jenkins outlines AARP's priorities for Americans age 50 and older, including protecting Medicare and Social Security, ensuring access to affordable health care coverage, and lowering the cost of prescription drugs.

In the letter Jenkins writes to President-elect Trump that "Our nearly 38 million members nationwide and all older Americans are counting on you to protect their Medicare and Social Security benefits, protect their access to affordable health care, and to tackle the high cost of prescription drugs. Throughout the campaign, your statements on these important issues of health and financial security set you apart from many other candidates. Now, as you assume office, older Americans are looking to you to protect them from efforts to cut their benefits, increase their costs, or otherwise harm the crucial programs they rely on."

Here is the full text of the letter to President-elect Trump:

:

President-elect Donald J. Trump

Presidential Transition Headquarters

Washington, DC

Dear President-elect Trump:

Congratulations on your election. We look forward to working with you on your campaign promises to America's seniors. Our nearly 38 million members nationwide and all older Americans are counting on you to protect their Medicare and Social Security benefits, protect their access to affordable health care, and to tackle the high cost of prescription drugs. Throughout the campaign, your statements on these important issues of health and financial security set you apart from many other candidates. Now, as you assume office, older Americans are looking to you to protect them from efforts to cut their benefits, increase their costs, or otherwise harm the crucial programs they rely on.

Medicare and Social Security

Our members count on these programs and they believe Social Security and Medicare must be protected and strengthened for today's seniors and future generations. Unfortunately, some congressional leaders have discussed plans to use the health care debate to fundamentally change the Medicare program and undermine the contract made with generations of Americans. Proposals creating a defined contribution premium-support program; restricting access by raising the age of eligibility; or allowing hospitals and providers to arbitrarily charge consumers higher prices than Medicare; all betray the promise made to older Americans who have paid into Medicare their entire working lives. Indeed, these proposals do little to actually lower the cost of health care. Rather, they simply shift costs from Medicare onto individuals – many of whom cannot afford to pay more for their care. Again, we are ready to stand with you to oppose attempts to cut the Medicare program or otherwise harm seniors.

The average senior, with an annual income of under $25,000 and already spending one out of every six dollars on health care, counts on Social Security for the majority of their income and on Medicare for access to affordable health coverage. We will continue to oppose changes to current law that cut benefits, increase costs, or reduce the ability of these critical programs to deliver on their benefit promises. We urge you to continue to do so as well.

Prescription Drugs

Older Americans use prescription drugs more than any other segment of the U.S. population, typically on a chronic basis. In 2015, retail prices for 268 brand name prescription drugs widely used by older Americans increased by an average of 15.5 percent. In contrast, the general inflation rate was 0.1 percent over the same period. For older adults, affordable prescription drugs are critical in managing their chronic conditions, curing diseases, keeping them healthy and improving their quality of life. As you have stated, older Americans and the American people deserve a better deal on prescription drug costs.

Again, we stand ready to work with you to lower drug prices. For example, AARP supports providing the Secretary of Health and Human Services with the authority to negotiate lower drug prices on behalf of millions of Medicare beneficiaries. In addition, we agree with you that we should reduce barriers to better pricing competition worldwide by allowing for the safe importation of lower priced drugs. American seniors should not have to continue paying the highest Rx prices in the world.

Access to Health Care pre-Medicare

Millions of older Americans age 50 and older have gained access to affordable health coverage through important changes in the health insurance market, including the ban on pre-existing condition exclusions, the ban on lifetime and annual coverage limits, the restriction on charging working as well as retired older Americans many times more for insurance than younger persons (through important limits on age rating), and additional help for those who cannot afford insurance. We urge you to protect these vulnerable older Americans (many who have lost their jobs, are self-employed or own their own businesses) from losing health coverage by maintaining these important insurance market reforms in any new health legislation.

Medicaid and Long-Term Services and Supports

Medicaid serves as a critical safety net for millions of people in every state, including over 17 million children with disabilities, adults with disabilities and poor elderly who rely on vital Medicaid health and long-term care services. We urge you to continue to protect these vulnerable populations.

Efforts to reduce or cap Medicaid funding could endanger the health, safety, and care of millions of individuals who depend on the essential services provided through this program. Furthermore, caps would likely result in overwhelming cost-shifts to state governments unable to shoulder the costs of care without sufficient federal support. As your Administration considers changes to Medicaid, we urge that home and community-based services be available to individuals in the same way they can access nursing home funding. Any health law changes should ensure that more individuals are able to receive services in their homes and communities rather than costly institutional care.

We look forward to working with you to protect Medicare and Social Security, to lower prescription drug prices, and to maintain older American's affordable access to quality health coverage. If you have any questions, please feel free to contact me, or have your staff contact Joyce A. Rogers, Senior Vice President, Government Affairs at (XXX) XXX-XXXX.

Sincerely,

Jo Ann C. Jenkins

Chief Executive Officer

Molly Crusen Bishop: Griffith Dickison, true pioneer

- Details

- Published on 13 January 2017

- Written by Molly Crusen Bishop

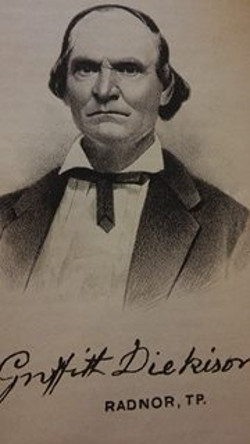

Griffith Dickison was one of Peoria area’s earliest settlers. He was born to farmers in Indiana on Nov. 27, 1811. His education was the real world and real life, and whatever minimal schooling was available during that time period in Switzerland, Indiana.

Griffith Dickison was one of Peoria area’s earliest settlers. He was born to farmers in Indiana on Nov. 27, 1811. His education was the real world and real life, and whatever minimal schooling was available during that time period in Switzerland, Indiana.

Despite the lack of a significant formal education Griffith’s intelligence and fortitude were vast. Griffith is a wonderful example of the heartiness of the old settlers to Peoria.

Despite the lack of a significant formal education Griffith’s intelligence and fortitude were vast. Griffith is a wonderful example of the heartiness of the old settlers to Peoria.

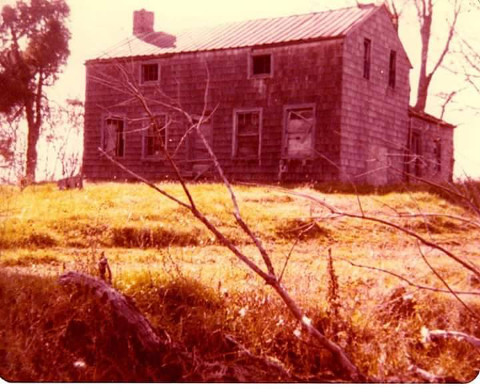

He married Achsah Bennett and had three children. He brought his family here by covered wagon and horses and built a home just outside of Peoria, in Dunlap in 1835. There is still a private family cemetery located on Dickison Cemetary Road in Dunlap, and his family still owns land in the area.

Griffith built the wooden farmhouse overlooking a valley so they would be able to see threats of any groups of Native Americans who could possibly attack Griffith and his family.

Griffith built the wooden farmhouse overlooking a valley so they would be able to see threats of any groups of Native Americans who could possibly attack Griffith and his family.

Preceding the pioneers in the Peoria area, there was a Black Hawk War between the United States and Native Americans. This involved many local tribes including the Kickapoos, and took place in Illinois in 1832. It generally wasn’t safe for white settlers and there was a movement to push the Indians farther West, and away from this part of the country.

It was difficult for people trying to settle in what was then the western part of the United States and quite often inter-tribal warfare contributed to the danger for the settlers. By the end of the war, many Native Americans retreated to the Mississippi River and this was the beginning of a deluge of new settlers coming from the eastern states. Incidentally, Abraham Lincoln served in the Black Hawk War.

It was difficult for people trying to settle in what was then the western part of the United States and quite often inter-tribal warfare contributed to the danger for the settlers. By the end of the war, many Native Americans retreated to the Mississippi River and this was the beginning of a deluge of new settlers coming from the eastern states. Incidentally, Abraham Lincoln served in the Black Hawk War.

Life in the new frontier was extremely rough. The eastern states had mills and business of all kinds. The new west had little to no establishments to help settlers acquire necessities for survival. They had no knowledge of the local plants, trees or animals and had to work incredibly hard to find their way. Griffith had to find water, food, and resources. His wife had to cook and care for the children. Disease and hunger were daily concerns.

The first gravestone in the historic Dickison Cemetary is for a 4-year-old little girl that came with the Dickison expedition. She died in a prairie fire.

The first gravestone in the historic Dickison Cemetary is for a 4-year-old little girl that came with the Dickison expedition. She died in a prairie fire.

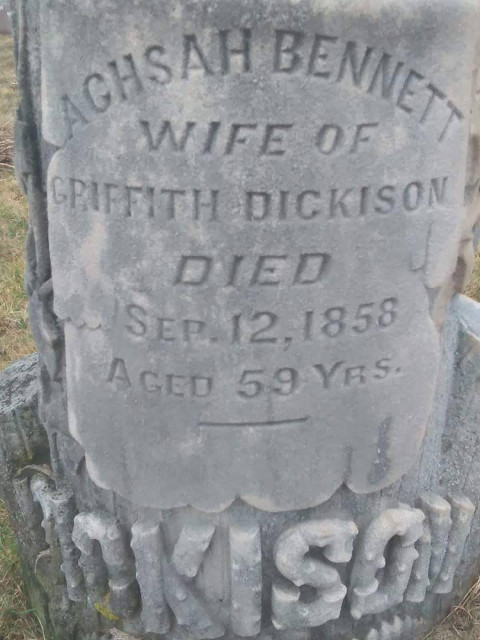

Griffith’s wife Achsah died Sept. 12, 1858. He married Margaret Johnson and had a child and divorced. Little more is known about this portion of his life. He again married, to Sarah Robinson, and had six more children, giving him 10 children.

Griffith made a fortune. At first he owned only a few acres of land, but he turned that into more than one thousand acres of land just outside of Peoria. He later owned much livestock and had even more success in his cattle and through land speculations. Griffith also owned stocks, shares, and bonds in the United States railroads.

He was a self-made man who had a scrupulous reputation and was filled with integrity in his many successful business dealings. It is amazing what the pioneers were able to accomplish in a time when there were no grocery stores or supply stores around. Everything had to be made by their own wits and strength.

If they needed milk, they had to have a cow, and feed and care for the cow. If they needed eggs to eat, they had to have chickens, feed and care for the chickens. They had to find or grow fabrics to make their own clothing and linens, as well. There were no doctors or medicines to heal. If a wagon wheel broke, one would have to cut down a tree and make a new one. They had to grow their own fruit and vegetables, as well.

If they needed milk, they had to have a cow, and feed and care for the cow. If they needed eggs to eat, they had to have chickens, feed and care for the chickens. They had to find or grow fabrics to make their own clothing and linens, as well. There were no doctors or medicines to heal. If a wagon wheel broke, one would have to cut down a tree and make a new one. They had to grow their own fruit and vegetables, as well.

Life was difficult at best, and these people were true testaments to the spirit of the human being.

Griffith Dickison died March 14, 1887 and is also buried in the family cemetery. His son Griffith E. served for the Union during the Civil War in the Illinois infantry, and fought bravely from his enlistment in 1862 to the end of the war, carrying on the family tradition of fortitude and loyalty.

The land surrounding the Dickison farm and cemetery is beautiful. One can still feel the awe of the pure nature of the lands. Griffith Dickison and his family were a perfect example of the pioneers who bravely made their way and settled in the wilderness and wildness of the Peoria area in the early 1830s.

Special thanks to two of Griffith’s great-great-great-grandchildren, Janis Straesser and Tim Harr.

Janis is related through Griffith’s wife Achsah and she is also a Daughter of the American Revolution going back with Griffith. She is also a popular weaver and does brilliant work. Tim Harr is related to Griffith through his wife Sarah and is still local as well.

I also want to thank members of Griffith’s family, Gerald and Amy Ulrich, for taking me on a tour of the family property and cemetery and for supplying photographs of the homestead.

All provided insight into their ancestor, who was one of the Peoria area’s oldest settlers, and an amazing example of a Pioneer.

Another stellar year at Downing Peoria International Airport

- Details

- Published on 17 January 2017

- Written by Paul Gordon

Not every year can be a record setter, but 2016 was nonetheless a stellar one for the General Wayne A. Downing Peoria International Airport.

Not every year can be a record setter, but 2016 was nonetheless a stellar one for the General Wayne A. Downing Peoria International Airport.

The airport announced Tuesday that 623, 134 passengers used it in 2016, less than 3 percent off 2015’s record-setting year, when 641,477 passengers went through, making it the fourth consecutive record-setting year.

Other highlights from 2016 included:

- The airport opened and dedicated its new international terminal last April. The terminal is named the Ray LaHood International Terminal in honor of the former U.S. Secretary of Transportation and Congressman Ray LaHood of Peoria. The new terminal has a full-service Customs and Border Protection facility as well as dual-purposes gates for domestic and international travel.

- New twice-daily flights to Charlotte, North Carolina were added in November, giving central Illinois direct access to six major hubs. That includes four of the five most connected airports in the world. Now with 12 destinations, PIA has more nonstop flights than any other Illinois airport outside of Chicago.

- The Peoria airport achieved a perfect score from the Federal Aviation Administration during a rigorous annual certification and safety inspection.

“We made a number of strides in 2016 that we are particularly proud of, including opening the new international terminal,” said Gene Olson, director of airports for the Metropolitan Airport Authority of Peoria. “Our growth trajectory has been such that we needed, and immediately filled, the new gates we added earlier this year.”

Olson said 2017 is off to a good start. In February, American Airlines will upgrade to larger jets for flights to Dallas/Fort Worth International Airport (DFW), offering first class service in Peoria for the first time in many years.

Additionally, low-cost carrier Allegiant recently announced that it will add seasonal service to Destin-Fort Walton Beach Airport (VPS), starting in May.

“We expect a direct flight to the Emerald Coast will be very popular because of the many generations from this area who vacation there, and we’ve been overwhelmed by positive responses since the announcement,” Olson said. “Meanwhile, Charlotte, our newest route, continues to gain steam as travelers recognize that it is a great way to connect to the East Coast and abroad.”

Charlotte-Douglas International Airport (CLT) is American Airlines’ second-largest hub, with more than 700 daily flights, including daily connections to key cities such as Washington, D.C., New York City, Boston and Baltimore.

OAG, an aviation data analytics company, recently released its 2016 Megahubs Index, which measured possible connections at the world’s 100 largest airports. Chicago O’Hare International Airport led the list, followed by Atlanta, Dallas/Fort Worth, Denver and Charlotte.

With the addition of Charlotte, PIA now flies to four of the five most connected airports in the world.

“We know that travelers have options so we very much appreciate the community’s support,” said Olson. “For our part, we’re going to continue to make PIA the airport that people want to travel from.”

Do you expect to die in debt?

- Details

- Published on 13 January 2017

- Written by PRNewswire

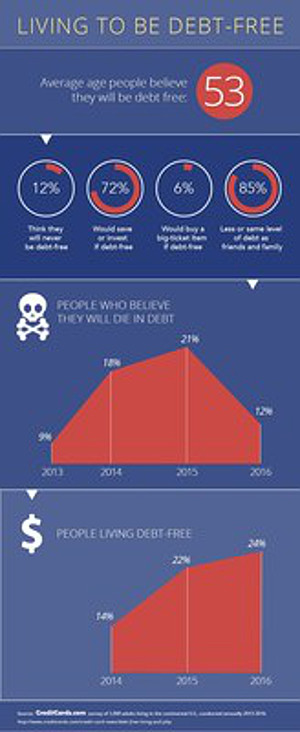

Just 12 percent of U.S. adults with debt expect to die in debt, down from 21 percent about a year ago, according to a new CreditCards.com report.

Just 12 percent of U.S. adults with debt expect to die in debt, down from 21 percent about a year ago, according to a new CreditCards.com report.

Click here for more information: http://www.creditcards.com/credit-card-news/debt-free-living-poll.php

The improvement was relatively consistent across age groups:

- 28 percent of those age 65 and older never expect to get out of debt (down from 35 percent in November 2015)

- 14 percent of those between the ages of 50 and 64 never expect to get out of debt (down from 24 percent in November 2015)

- 11 percent of those between the ages of 30 and 49 never expect to get out of debt (down from 19 percent in November 2015)

- 4 percent of those between the ages of 18 and 29 never expect to get out of debt (down from 11 percent in November 2015)

24 percent of American adults say they are currently debt-free, the highest reading in the three consecutive years CreditCards.com has conducted this survey. In December 2014, just 14 percent said they were debt-free. This refers to all types of debt: credit cards, car loans, student loans, mortgages, etc.

The election of Donald Trump to the presidency may have brightened the financial outlook of indebted Republicans and independents more so than Democrats. Only 12 percent of Republicans and 11 percent of independents surveyed say they will never get out of debt – down from 25 percent and 21 percent in late 2015, respectively. Meanwhile, the portion of Democrats who say they will die in debt fell from 14 percent in late 2015 to 10 percent now.

The election of Donald Trump to the presidency may have brightened the financial outlook of indebted Republicans and independents more so than Democrats. Only 12 percent of Republicans and 11 percent of independents surveyed say they will never get out of debt – down from 25 percent and 21 percent in late 2015, respectively. Meanwhile, the portion of Democrats who say they will die in debt fell from 14 percent in late 2015 to 10 percent now.

Most debtors say they would be responsible with the extra money if their debt was magically erased today. 72 percent would put the windfall toward some sort of savings, led by retirement (32 percent) and followed by emergency expenses (15 percent), a new home (14 percent) and a college fund (12 percent). Just 6 percent would splurge on a vacation or other big-ticket item.

The allure of keeping up with the Joneses seems to be fading: Only 9 percent of U.S. adults report more debt than their closest friends and family. 48 percent say they have less debt and 37 percent believe they have about the same amount.

"While it's good to see Americans feeling better about their debt, I'm worried that some people are getting carried away," said Matt Schulz, CreditCards.com's senior industry analyst. "For example, credit card debt has been rising steadily for more than five years and is close to $1 trillion, according to the Federal Reserve. It seems like a lot of people are forgetting the painful lessons of the Great Recession."

The survey was conducted by Princeton Survey Research Associates International. PSRAI obtained telephone interviews with a nationally representative sample of 1,000 adults living in the continental United States. Interviews were conducted by landline (500) and cell phone (500, including 305 without a landline phone) in English and Spanish by Princeton Data Source from December 8-11, 2016. Statistical results are weighted to correct known demographic discrepancies. The margin of sampling error for the complete set of weighted data is plus or minus 3.7 percentage points.

Just 12% of U.S. adults with debt expect to die in debt, down from 21% about a year ago, according to a new CreditCards.com report. Click here for more information:

http://www.creditcards.com/credit-card-news/debt-free-living-poll.php

The improvement was relatively consistent across age groups:

- 28% of those age 65 and older never expect to get out of debt (down from 35% in November 2015)

- 14% of those between the ages of 50 and 64 never expect to get out of debt (down from 24% in November 2015)

- 11% of those between the ages of 30 and 49 never expect to get out of debt (down from 19% in November 2015)

- 4% of those between the ages of 18 and 29 never expect to get out of debt (down from 11% in November 2015)

24% of American adults say they are currently debt-free, the highest reading in the three consecutive years CreditCards.com has conducted this survey. In December 2014, just 14% said they were debt-free. This refers to all types of debt: credit cards, car loans, student loans, mortgages, etc.

The election of Donald Trump to the presidency may have brightened the financial outlook of indebted Republicans and independents more so than Democrats. Only 12% of Republicans and 11% of independents surveyed say they will never get out of debt – down from 25% and 21% in late 2015, respectively. Meanwhile, the portion of Democrats who say they will die in debt fell from 14% in late 2015 to 10% now.

Most debtors say they would be responsible with the extra money if their debt was magically erased today. 72% would put the windfall toward some sort of savings, led by retirement (32%) and followed by emergency expenses (15%), a new home (14%) and a college fund (12%). Just 6% would splurge on a vacation or other big-ticket item.

The allure of keeping up with the Joneses seems to be fading: Only 9% of U.S. adults report more debt than their closest friends and family. 48% say they have less debt and 37% believe they have about the same amount.

"While it's good to see Americans feeling better about their debt, I'm worried that some people are getting carried away," said Matt Schulz, CreditCards.com's senior industry analyst. "For example, credit card debt has been rising steadily for more than five years and is close to $1 trillion, according to the Federal Reserve. It seems like a lot of people are forgetting the painful lessons of the Great Recession."

The survey was conducted by Princeton Survey Research Associates International. PSRAI obtained telephone interviews with a nationally representative sample of 1,000 adults living in the continental United States. Interviews were conducted by landline (500) and cell phone (500, including 305 without a landline phone) in English and Spanish by Princeton Data Source from December 8-11, 2016. Statistical results are weighted to correct known demographic discrepancies. The margin of sampling error for the complete set of weighted data is plus or minus 3.7 percentage points.