Manpower survey shows positive jobs outlook for Illinois

- Details

- Published on 10 June 2014

- Written by PRNewswire

Employers in Illinois expect to hire at a solid pace during the third quarter of 2014, according to the Manpower Employment Outlook Survey released Tuesday.

Employers in Illinois expect to hire at a solid pace during the third quarter of 2014, according to the Manpower Employment Outlook Survey released Tuesday.

From July to September, 18 percent of the companies interviewed plan to hire more employees, while 5 percent expect to reduce their payrolls. Another 75 percent expect to maintain their current staff levels and 2 percent are not certain of their hiring plans. This yields a Net Employment Outlook of 13 percent.

“The third quarter survey results show slightly stronger optimism about hiring expectations compared to Quarter 2 when the Net Employment Outlook was 11 percent,” said Manpower spokesperson Anne Edmunds. “Compared to one year ago when the Net Employment Outlook was 9 percent, employers anticipate an uptick in the hiring pace.”

Summary of Results for Illinois

|

Increase Staff Levels |

Decrease Staff Levels |

Maintain Staff Levels |

Don’t Know |

Net Employment Outlook |

|

|

Q3 2014 |

18% |

5% |

75% |

2% |

13% |

|

Q2 2014 |

14% |

3% |

80% |

3% |

11% |

|

Q3 2013 |

18% |

9% |

71% |

2% |

9% |

*The Net Employment Outlook is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting a decrease in hiring activity.

For the coming quarter, job prospects appear best in Construction, Nondurable Goods Manufacturing, Transportation & Utilities, Wholesale & Retail Trade, Information, Professional & Business Services, Education & Health Services, Leisure & Hospitality, Other Services and Government. Employers in Durable Goods Manufacturing plan to reduce staffing levels, while hiring in Financial Activities is expected to remain unchanged.

Of the more than 18,000 employers surveyed in the United States, 22 percent expect to add to their workforces, and 4 percent expect a decline in their payrolls during Quarter 3 2014. Seventy-one percent of employers anticipate making no change to staff levels, and the remaining 3 percent of employers are undecided about their hiring plans. When seasonal variations are removed from the data, the Net Employment Outlook is +14%, a one point increase from the Quarter 2 2014 Net Employment Outlook of +13%.

That is the best outlook since the second quarter of 2008, Manpower said.

U.S. Results Summary

Of the more than 18,000 U.S. employers surveyed, 22 percent anticipate an increase in staff levels in their Quarter 3 2014 hiring plans, while anticipated staff reductions remain among the lowest in survey history at 4 percent. Seventy-one percent of employers expect no change in their hiring plans. The final 3 percent of employers are undecided about their hiring intentions, resulting in a Net Employment Outlook of +18%. When seasonally adjusted, the Net Employment Outlook becomes +14%.

Incremental Growth in Hiring Levels Continues in U.S. Among 18,000 Surveyed Employers

|

Quarter |

Increase Staff Levels |

Decrease Staff Levels |

Maintain Staff Levels |

Don’t Know |

Net Employment Outlook(deseasonalized) |

|

Q3 2014(current) |

22% |

4% |

71% |

3% |

14% |

|

Q2 2014(previous quarter) |

19% |

4% |

73% |

4% |

13% |

|

Q3 2013(one year ago) |

22% |

6% |

70% |

2% |

12% |

“We’re seeing a measured level of improvement across all labor segments that has been building over the last five years,” said ManpowerGroup CEO Jonas Prising. “While dramatic jumps in hiring are uncommon, we continue to see a slow, yet steady, increase in demand for talent from our clients as they take a holistic approach in rebuilding their employee base.”

The third quarter research shows that U.S. employers expect hiring intentions to remain relatively stable quarter-over-quarter across all regions, and slightly increase compared to one year ago at this time. Employers have a positive Outlook in all 13 industry sectors included in the survey, with Mining, Wholesale & Retail Trade and Leisure & Hospitality employers reporting the strongest hiring intentions.

Among the 50 states, employers in North Dakota, Delaware, Michigan, Minnesota, Alaska and Idaho indicate the strongest Net Employment Outlooks, while New Mexico, Mississippi, Kansas, Nevada, Illinois and Florida project the weakest Outlooks.

Commute, housing costs top reasons for moving in the past year

- Details

- Published on 10 June 2014

- Written by PRNewswire

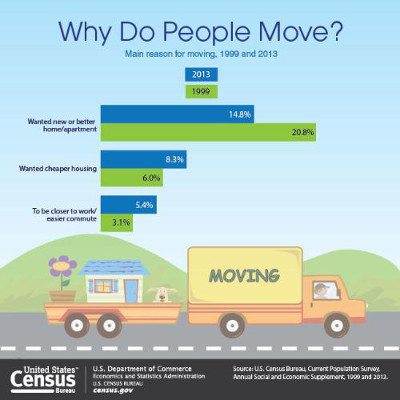

Among the 36 million people 1 year and over who moved between 2012 and 2013, 5 percent said the most important reason for moving was to be closer to work or for an easier commute, while another 8 percent cited the desire for cheaper housing, according to a report released by the U.S. Census Bureau.

Among the 36 million people 1 year and over who moved between 2012 and 2013, 5 percent said the most important reason for moving was to be closer to work or for an easier commute, while another 8 percent cited the desire for cheaper housing, according to a report released by the U.S. Census Bureau.

The most common reasons for moving in 2013 were "wanted new or better home/apartment," "other housing reason" and "other family reason."

The report, Reason for Moving: 2012 to 2013, presents an in-depth look at 19 reasons why people changed residences during the previous year and is the Census Bureau's first on this topic since 2001.

The Current Population Survey began asking a comparable version of this question in 1999. Today's report compares how these reasons have changed over time. In 1999, 3 percent moved to be closer to work or for an easier commute and 6 percent wanted cheaper housing while 21 percent of respondents "wanted [a] new or better home/apartment." This reason declined to 15 percent in 2013 and was not statistically different from the "other family" reason.

"We asked people to select the reason that contributed most to their decision to move. Picking one reason can be difficult as moves are often motivated by many different, and oftentimes competing, factors," said the report's author, David Ihrke, a demographer in the Census Bureau's Journey to Work and Migration Statistics Branch. "For instance, if one's primary reason for moving is to be closer to work or having an easier commute, they may have to sacrifice other preferences. This could include forgoing cheaper housing options or settling for a different neighborhood. If they mainly want cheaper housing, they may have to deal with a longer commute."

In addition to presenting the specific reasons for moving, the report combines these reasons into four collapsed categories: housing-related (48 percent); family-related, such as a change in marital status or establishing one's own household (30 percent); job-related (19 percent); and other (2 percent).

For people who moved from one county to another, moving because of a job-related reason rose with the distance of the move: 23 percent of moves less than 50 miles and 48 percent of those 500 miles or more. Moving for housing-related reasons showed change in the opposite direction, comprising 42 percent of shorter distance moves and 18 percent of longer distance ones.

Other highlights:

- Men were more likely than women to move for job-related reasons.

- Better-educated people were more likely to move for job-related reasons than those with lower levels of education.

- Married respondents were the least likely to move for family-related reasons.

- Moves within the same county were typically for housing-related reasons, while intercounty moves and moves from abroad were more for job-related reasons.

- Several individual reasons, such as "change of climate," "health reasons" and "natural disaster," were each cited as the main reason for moving by fewer than 1 percent of householders.

The data are analyzed by a range of demographic characteristics, including age, sex, race, Hispanic origin, educational attainment, marital status, labor force status, type of move and distance moved. These national-level data were collected by the 2013 Current Population Survey's Annual Social and Economic Supplement.

For people who are seeking to move, dwellr, a new Census Bureau app powered by American Community Survey statistics, can pull up a list of U.S. locations that matches users' preferences for such variables as city size, geographic region and job type.

Cat will close three northern Illinois plants, move 170 jobs to Michigan

- Details

- Published on 06 June 2014

- Written by Paul Gordon

Caterpillar Inc. announced Friday it will close three northern Illinois factories that make couplings and move the 170 jobs to a facility in Menominee, Michigan.

Caterpillar Inc. announced Friday it will close three northern Illinois factories that make couplings and move the 170 jobs to a facility in Menominee, Michigan.

The Anchor Coupling Inc. plants ̶̶ two in Sterling and one in Dixon ̶ will be shut down by the end of the first quarter next year, Caterpillar said in its announcement. Anchor Coupling is a wholly owned subsidiary of Caterpillar.

The employees, who were aware Caterpillar was studying the possibility of consolidating Anchor Coupling manufacturing and distribution operations in one facility, were informed of the decision on Friday, the company said. The Dixon plant and one of the Sterling plants were manufacturing facilities while the other Sterling plant was a distribution facility. The Anchor plant in Menominee does both product and distribution.

“Consolidating production and logistics to one location will enable us to better meet our customers' expectations by reducing costs, driving efficiency and utilizing existing assets,” the company said.

Anchor Coupling manufactures hydraulic hose assemblies for Cat machines as well as other original equipment manufacturers.

Caterpillar has been critical in the past of the Illinois business climate and its leadership has said the cost of doing business in this state could be a factor in future decisions.

Spokeswoman Rachel Potts acknowledged that was the case here, but said it was not the only or even the chief consideration. “Certainly in a decision like this business climate is always considered,” she said. “But the real driver of this decision was the cost structure.”

Caterpillar has owned the Dixon plant since the late 1960s and it opened the Sterling facilities in the mid-1990s. The Menominee plant, where Anchor Coupling is based, has been around since 1938, according to its website.

It said there are Anchor Coupling assembly plants in the United States, Belgium and the United Kingdom.

In the company’s announcement Greg Folley, Caterpillar vice president of the Remanufacturing, Components and Work Tools Division, said the company recognizes the difficulty the decision is for them.

“We value and appreciate the work that our Sterling and Dixon employees have contributed and their dedication to producing and distributing quality products. This decision is not about the performance of these plants, but rather about improving efficiency across the component manufacturing footprint and reducing the cost structure driven by three independent facilities, while providing the highest quality products to our customers,” Folley said.

The plants in Sterling and Dixon will ramp down production beginning in the fourth quarter 2014 with the final transition to be completed in the first quarter 2015.

Employees who are displaced will be offered severance packages from the company and outplacement services from appropriate agencies to ensure they have the necessary support during this transition, the announcement said.

Freilinger to head Peoria Downtown Development Corp.

- Details

- Published on 09 June 2014

- Written by Paul Gordon

MIchael Freilinger has experience developing downtown areas in other cities, Des Moines chief among them. He believes that will serve him well in his new position as president of the newly formed Downtown Development Corporation of Peoria.

MIchael Freilinger has experience developing downtown areas in other cities, Des Moines chief among them. He believes that will serve him well in his new position as president of the newly formed Downtown Development Corporation of Peoria.

Freilinger was announced Monday as the head of the new agency that will be charged with transforming Peoria’s downtown and the Warehouse District as work in that continues.

“I had lots of opportunities to work on that type of development in the past so I decided to pursue the position. It seemed like an excellent fit and it gives me the opportunity to stay here,” Freilinger said.

Freiling, 54, an Iowa native, was Tazewell County Administrator since April 2012 and recently announced he was leaving that job to become city administrator in Independence, Iowa. However, the Peoria downtown position came available within the 30-day period he could opt out of the Independence job and he chose to do so.

While his tenure in Tazewell County was relatively brief, it was successful. Freilinger developed the first strategic plan for Tazewell County, successfully negotiated an expansion agreement with Monsanto for a $25 million expansion, and helped develop a solution for the Pekin landfill.

Over the last 25 years Freilinger’s career includes more than 10 years in executive leadership positions in economic development, strategic planning, fiscal management, and downtown redevelopment. Before coming to Tazewell County he was a senior partner at Strategic Solutions Partners, County Manager of Osceola County, Florida and County Administrator for Polk County, Iowa.

In Osceola County and Polk County, Freilinger was credited with recruiting new and expanding existing businesses, generating hundreds of new jobs in Osceola County and over 2,500 new jobs in Polk County.

Chris Glynn, chairman of the Downtown Development Corp. board of directors, said he is confident Freilinger has the leadership and experience needed for the DDC position. “His knowledge of the Greater Peoria region partnered with his background in economic development makes him the ideal candidate to lead the DDC. As a recognized area leader, Michael’s ability to collaborate well with others will help drive the changes needed in Downtown Peoria,” Glynn said.

Freilinger said he recognizes the work that has transpired to get downtown redevelopment and the Warehouse District to where it is today. “We now have the resources to turn that vision into a reality by fostering a vibrant and thriving community in Downtown Peoria and the warehouse district,” he said.

He cautioned that it will not happen overnight so patience will be needed. “This task will be significant. We will take it one day at a time and it will start to build momentum. Then things can start to happen more quickly,” he said.

Freilinger said he did not find the plans already in place to be daunting. “I’m supportive of what is being proposed. It’s a good plan. But it does take time to implement,” he said.

He added he feels excited about the Warehouse District and its plans, including the projected demand to add 200 to 220 residential units to the region each year over the next five years. While he isn’t working with any other set time frame, he said the public will start seeing progress and hearing announcements within a year.

“There can be a misunderstanding with the public about how long some of these things can take so we will communicate what we are doing. And there are things we will continue to do or start to do in the interim to keep the public interested in the potential for our downtown,” Freilinger.

For now Freilinger will be working alone. Support services will be provided by the CEO Council.

The CEO Council last year agreed to take on downtown-warehouse development as one of its initial areas of focus after research showed Peoria may be the largest American city without a downtown organization, according to a news release from the DDC.

“Best practices suggest that having a DDC is effective for accomplishing the goals and objectives of a downtown redevelopment effort. The CEO Council successfully launched the DDC as a stand-alone organization to serve as the leading entity to guide and sustain development in downtown Peoria. The DDC will ultimately become the organizational toolbox to coordinate development, management, marketing, and be a champion for development in Peoria’s downtown and warehouse district,” the release said.

The DDC, it added, will:

- Serve as the leading organization that champions, guides and sustains growth in Peoria’s downtown and warehouse district through best-practices in relationship, business and economic development.

- Address the supply of suitable downtown housing, recognizing the significant demand. An independent report estimates the need for 200+ units per year, for at least the next 5 years.

- Champion a pedestrian friendly environment in support of residential, business and economic growth in the downtown area.

- Foster a thriving – live, work, play – environment attractive to those seeking a vibrant urban community.

Other members of the DDC board of directors other than Glynn are Peoria City Council members Denise Moore and Ryan Spain; businessman Jake Hamann; Henry Vicary of Caterpillar Inc.; Roberta Parks of the UnityPoint Health – Methodist|Proctor Foundation, and Ron Jost. OSF HealthCare

Boomers hold more jobs, but millennials are hurting

- Details

- Published on 05 June 2014

- Written by PRNewswire

The jobs recovery has put spotlights on two large sections of the labor force: workers nearing the end of their careers and young adults just beginning them, according to a report issued Thursday by CareerBuilder and Economic Modeling Specialists International (EMSI).

The jobs recovery has put spotlights on two large sections of the labor force: workers nearing the end of their careers and young adults just beginning them, according to a report issued Thursday by CareerBuilder and Economic Modeling Specialists International (EMSI).

While the economy has been difficult for both groups, baby boomers now hold a larger percentage of jobs in science, technology, engineering and math (STEM) and other occupations than before the recession, while millennials have generally struggled to make headway four years into the recovery.

The number of jobs held by baby boomers (age 55-64) grew 9 percent from 2007 to 2013, a gain of 1.9 million. The millennial workforce (age 22-34), however, has not recovered from the recession nearly as fast. With an increase of only 110,000 jobs, employment in 2013 was essentially unchanged from 2007 (.3 percent growth).

This analysis explores the very different stories of millennials and baby boomers post-recession. EMSI's extensive labor market database pulls from over 90 national and state employment resources and includes detailed information on employees and self-employed workers.

An interactive, web-embeddable map and table of 175 U.S. metros supplements this report and can be found at the EMSI blog.

"The recession prompted boomers and millennials to approach the labor market differently. Confronted by weaker entry-level job prospects, young professionals left the workforce in greater numbers or took lower paying jobs that didn't take immediate advantage of their degrees," said Matt Ferguson, CareerBuilder CEO and co-author of The Talent Equation. "Older workers, on the other hand, often had to postpone retirement to recoup lost savings. Never in history have workers over the age of 55 had the concentration in the workforce they have today; however, employers will have to plan for vacancies when this group inevitably retires, which could quickly create new skills gaps in trade vocations and STEM fields."

Ferguson also expressed the need for more affordable college education options and reskilling opportunities for workers struggling to find employment, regardless of career stage.

"In a depressed labor market, we ideally want more people to acquire college degrees, but the rates of graduates did not spike during the recession," Ferguson said. "This suggests rising costs prohibited many people in need of new skills from obtaining them, a trend that needs to be reversed going forward."

Both demographic and behavioral factors provide explanations for boomers' and millennials' diverging paths. The aging population may be the most significant. According to the Bureau of Labor Statistics, the population of 55 and older Americans has grown 20 percent since 2007—four times as fast as prime-working age millennials (ages 25-34).

Moreover, the 55 and older group is the only age group to increase its labor force participation rate (+1.7 percentage points) and employment-to-population ratio (+.8 percentage points) since 2007. By comparison, Americans ages 25-34 saw a 2.1 and 4.3 percentage point drop in their labor force participation and employment-to-population ratio, respectively.

The following table shows percentage job change in selected occupational groups from 2007 to 2013. Outside of food preparation and serving jobs, boomers have increased their share of jobs held in each category, including STEM occupations, relative to millennials. Construction and architecture and engineering occupations were particularly difficult fields to enter for young workers, with 19 and 10 percent drops in employment, respectively.

|

Occupation Group |

Baby Boomers (Age 55-64) |

Millennials (Age 22-34) |

||

|

% Job Change |

2013 Share (Change) |

% Job Change |

2013 Share (Change) |

|

|

Food Preparation & Serving |

20% |

7% (+1) |

18% |

35% (+3) |

|

Healthcare Practitioners & Technical |

22% |

17% (+2) |

11% |

27% (+1) |

|

Computer & Mathematical |

20% |

11% (+1) |

2% |

32% (-1) |

|

Business & Financial Operations |

11% |

17% (+2) |

-1% |

27% (-1) |

|

Architecture & Engineering |

9% |

18% (+2) |

-10% |

27% (-1) |

|

Legal |

4% |

18% (+2) |

-5% |

26% (0) |

|

Construction & Extraction |

-3% |

12% (+2) |

-19% |

29% (-2) |

Of metro areas with one million or more residents, Pittsburgh, PA, Hartford, CT, and Cleveland, OH, have the largest share of workers age 55-64. Aging workforces in these regions' strong manufacturing industries underlie the high concentration. At the other end of the spectrum, Salt Lake City leads all markets for jobs held by workers age 22-34. Millennials dominate the area's emerging computer, health care and finance occupations.

|

Rank |

Boomers |

Millennials |

||

|

Metro |

% Share |

Metro |

% Share |

|

|

1 |

Pittsburgh, PA |

17.7% |

Salt Lake City, UT |

34.1% |

|

2 |

Hartford, CT |

17.2% |

Austin, TX |

31.4% |

|

3 |

Cleveland, OH |

17.2% |

San Diego, CA |

29.7% |

|

4 |

Philadelphia, PA |

16.3% |

San Antonio, TX |

29.5% |

|

5 |

Providence, RI |

16.2% |

Phoenix, AZ |

29.2% |

|

6 |

Portland, OR |

16.1% |

Seattle-Tacoma, WA |

29.2% |

|

7 |

Tampa, FL |

16.0% |

Oklahoma City, OK |

29.0% |

|

8 |

Rochester, NY |

16.0% |

New Orleans, LA |

28.9% |

|

9 |

Buffalo-Niagara Falls, NY |

16.0% |

Minneapolis-St. Paul, MN |

28.8% |

|

10 |

Milwaukee, WI |

16.0% |

Washington, DC |

28.6% |

Mirroring job growth for all age groups, Houston and Austin, TX, make up the top two metros for percentage growth among boomers and millennials.

|

Rank |

Boomers |

Millennials |

||

|

Metro |

Growth |

Metro |

Growth |

|

|

1 |

Houston, TX |

23% |

Austin, TX |

11% |

|

2 |

Austin, TX |

22% |

Houston, TX |

9% |

|

3 |

Salt Lake City, UT |

18% |

New Orleans, LA |

9% |

|

4 |

Dallas, TX |

18% |

Buffalo-Niagara Falls, NY |

9% |

|

5 |

Denver, CO |

16% |

San Antonio, TX |

8% |

|

6 |

San Antonio, TX |

16% |

Dallas, TX |

7% |

|

7 |

San Jose, CA |

15% |

Pittsburgh, PA |

6% |

|

8 |

Indianapolis, IN |

15% |

Rochester, NY |

6% |

|

9 |

Pittsburgh, PA |

14% |

Oklahoma City, OK |

6% |

|

10 |

Nashville, TN |

14% |

Denver, CO |

5% |

For more detailed analysis, visit EMSI's blog or view detailed data on the interactive map.

Economic Modeling Specialists Intl., a CareerBuilder company, turns labor market data into useful information that helps organizations understand the connection between economies, people, and work. For more information, visit www.economicmodeling.com.

CareerBuilder is the global leader in human capital solutions, helping companies target and attract great talent.